By Bella Angomoko

Small and Medium Enterprises (SMEs) are central to South Africa’s economic engine. They contribute roughly 55% of the country’s gross domestic product and account for up to 60% of employment. Beyond their quantitative impact, SMEs promote competition, drive innovation, and provide consumers with greater choice, while generating dynamic efficiencies in various sectors.

Despite their vital role, many SMEs face significant barriers to accessing finance. Traditional lenders, as well as government-backed initiatives, often fail to provide the long-term, patient capital these businesses need to scale. Building a business, especially as a smaller firm or a new entrant, is a long process. It requires time to experiment with strategies, invest in new technologies, innovate, expand operations, and navigate regulatory approvals in certain sectors. For such businesses, patient capital is not a luxury—it is essential for survival and growth.

This article examines the current state of commercial lending in South Africa, highlights the importance of development finance, and explores how the financial system can better meet the needs of underserved sectors.

The Limits of Traditional Lending

While South Africa’s banking sector has grown substantially since 1994, this growth has not translated into meaningful support for new entrants or small firms. Banks are generally risk-averse, often preferring to finance established businesses with proven financial records. This approach leaves a funding gap for smaller firms and startups, which are unable to meet traditional banks’ stringent lending requirements.

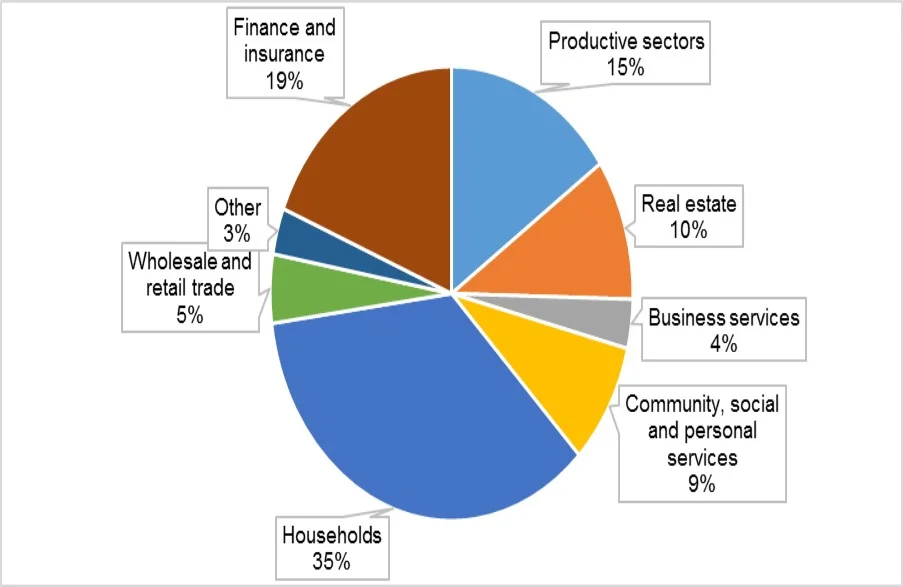

Evidence also suggests that financialization has skewed lending priorities. Companies often invest in reversible, short-term financial assets rather than long-term productive investments, diverting credit away from sectors that generate tangible economic growth. Banks also tend to extend more credit to consumers than to businesses, further restricting capital for productive enterprise.

Why Development Finance Matters

Development Finance Institutions (DFIs) have emerged as crucial actors in filling this financing gap. DFIs mobilize resources for sectors deemed too risky for private investors but essential for broader economic growth. By absorbing initial risks, DFIs create opportunities that the market would otherwise neglect. They collaborate with the private sector, gradually stepping back as markets mature, allowing resources to flow to other underserved areas.

Several case studies illustrate the critical role of patient capital:

- Grain Field Chickens (GFC): This poultry business, jointly owned by Vrystaat Koöperasie Beperk (VKB) and the Industrial Development Corporation (IDC), took four years to achieve profitability. During this period, backing from VKB and development finance from IDC allowed GFC to build scale, strengthen operational capabilities, and navigate the early challenges that most small firms face.

- Capitec Bank: Between 2002 and 2009, Capitec’s growth was constrained by a lack of adequate capital. Survival during this period was made possible largely due to the support of PSG, an investment holding company that acted as a reference shareholder and provided much-needed financing. Similarly, other small banks, like Ubank (formerly Teba Bank), have struggled to grow due to the absence of patient investors.

- Soweto Gold and Lethabo Milling: These black-owned businesses in beer brewing and maize milling faced years of funding rejections from both commercial banks and DFIs. Soweto Gold eventually secured international financing to complement its own resources and later accessed an IDC loan through the Agro-Processing Competitiveness Fund. Lethabo Milling obtained financing via the Massmart Supplier Development Fund, which facilitated entry into the milling sector. Both companies eventually achieved profitability and operational scale, demonstrating the transformative impact of patient capital.

These examples highlight a persistent shortfall in traditional financial markets: without long-term, risk-tolerant funding, promising enterprises struggle to navigate early-stage challenges.

Challenges with Provincial Development Finance

South Africa hosts a large number of provincial DFIs (PDFIs), each with distinct structures, mandates, and project scales. While their proximity to local communities allows them to respond to regional needs, overlap with national DFIs often leads to duplication and inefficiency. Additionally, the broadening mandates of PDFIs—sometimes functioning as general economic development agencies—dilute their focus on financing small enterprises.

Operational inefficiencies further constrain PDFIs. For example, the Gauteng Enterprise Propeller (GEP) spent 70% of its annual budget on salaries between 2011 and 2015, leaving only R30 million available for SME lending. On average, the wage bill across PDFIs is disproportionate to their lending capacity. High write-offs and impairment rates, reaching up to 60% for institutions like the Free State Development Corporation, underscore inefficiencies that hinder capital deployment.

A lack of reliable funding sources is a key challenge, compounded by these inefficiencies. Strengthening partnerships between DFIs and traditional finance institutions can offer an effective solution, enabling co-financing arrangements that mobilize resources for long-term investments while sharing risk.

Global Lessons: The Brazilian Model

The Brazilian Development Bank (BNDES) offers an instructive example. Partnerships between BNDES and commercial banks extend beyond co-funding projects to include distribution of funds to farmers through banks. This arrangement leverages the banks’ operational systems, broad reach, and efficiency, reducing costs and expanding the impact of development finance.

Similarly, South Africa’s co-funding initiatives, such as the Massmart/Walmart Supplier Development Fund, illustrate how structured support—through zero-interest grants and guaranteed loans—can bridge the gap for SMEs, providing them with the stability and capital needed to grow.

Policy Recommendations

- Increase Availability of Patient Capital: Long-term funding must be available to enable SMEs to invest, innovate, and expand without immediate repayment pressures.

- Improve DFI Efficiency: Streamline operations, reduce duplication between provincial and national DFIs, and focus mandates on financing small businesses effectively.

- Foster Public-Private Partnerships: Collaboration between commercial banks and DFIs can mobilize additional resources, mitigate risk, and expand access to capital for underserved sectors.

- Focus on Value Creation: Investments should prioritize productive sectors that generate employment, build local capacity, and stimulate economic growth rather than short-term financial returns.

- Encourage Co-Funding Models: Strategic partnerships, like those exemplified by BNDES and Massmart initiatives, can enhance risk appetite among private financiers and facilitate the delivery of patient capital.

Conclusion

Small businesses are vital for South Africa’s inclusive economic growth, yet their potential is constrained by traditional financial markets’ risk aversion and inefficiencies in development finance. Patient capital, delivered through DFIs and strategic public-private partnerships, can transform the landscape for SMEs.

By strengthening funding mechanisms, streamlining operations, and fostering collaboration, South Africa can empower small enterprises to scale, innovate, and contribute meaningfully to economic growth. Long-term, risk-tolerant investment is not just a financing strategy—it is a catalyst for sustainable development, job creation, and competitiveness in the broader economy.

The Author is Director of AVEB Training and Consulting.

This article first appeared on SA varsity News.