By Dennis Agaba

In a move underscoring shifting global economic dynamics, the United States has intensified efforts to secure critical mineral supplies from Africa as part of a broader strategy to reduce dependence on China and strengthen its own manufacturing and defence supply chains. The initiative comes amid growing geopolitical competition and heightened global demand for raw materials essential to emerging technologies.

Critical minerals—such as lithium, cobalt, manganese, and rare earth elements—are indispensable to an array of industries, from electric vehicles and renewable energy systems to advanced electronics and military hardware. With Africa home to some of the world’s richest deposits of these resources, the continent has increasingly become a focal point of international engagement by both governments and private investors.

A Strategic Turn in US Policy

Under the current US administration, Washington has signalled a renewed commitment to diversifying its sources of critical minerals, which are vital to economic competitiveness and national security. This policy shift has gained urgency as global tensions rise and as supply chain vulnerabilities exposed during the COVID‑19 pandemic put pressure on governments to rethink overreliance on single sources—particularly China, which currently dominates processing and refining of many key minerals.

The United States has launched diplomatic overtures and trade negotiations with mineral‑rich African nations, including the Democratic Republic of Congo (DRC), South Africa, Zimbabwe, and Malawi. These discussions aim to foster long‑term partnerships that would bring investment, technology, and infrastructure development in exchange for stable access to mineral resources.

“Engagement with Africa on critical minerals is not only about access to raw materials; it’s about building resilient, transparent supply chains that benefit both African economies and American industries,” said a senior US trade official involved in the talks.

Competing With China’s Footprint

China’s presence in Africa’s mineral sector has grown over the past two decades, supported by trade, financing, and infrastructure projects across the continent. Chinese companies have secured stakes in major mining operations, processing facilities, and export pipelines, giving Beijing significant influence over global mineral flows.

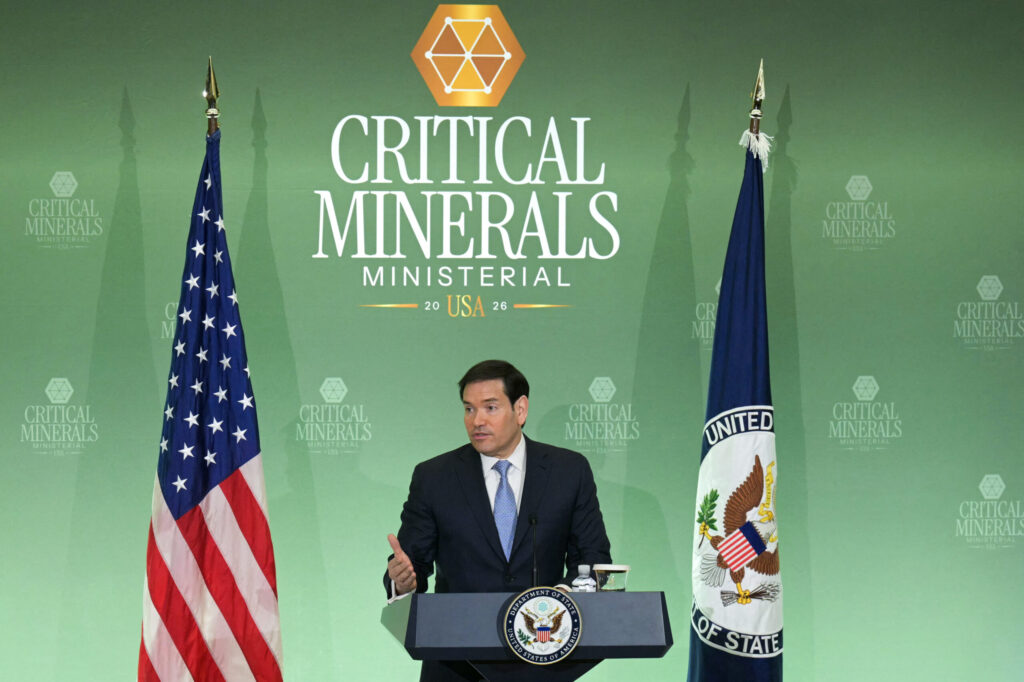

US efforts are framed as an alternative to this model—one that promotes transparency, environmental responsibility, and shared economic gains. In recent months, US delegations have held high‑level meetings with African ministers, business leaders, and regional blocs like the African Union to explore joint ventures and strategic frameworks for mineral development.

Officials from the US Department of State and the Department of Commerce have emphasised that the goal is not to displace China, but to offer African nations more options for partnerships that align with long‑term economic growth, governance standards, and sustainable development.

African Nations Weigh Opportunities and Risks

For African governments, the increased interest from Washington offers both promise and complexity. Many countries are eager to attract foreign direct investment that can catalyse economic transformation, create jobs, and finance infrastructure. Local leaders have underscored the potential benefits of partnerships that include technology transfer, skills development, and value‑addition industries such as refining and processing plants on the continent.

However, some analysts warn that African nations must balance competing offers from global powers in a way that protects sovereignty and ensures that local communities benefit from resource wealth. Questions around environmental protection, revenue transparency, and equitable profit sharing remain central to the negotiations.

“Securing investment in our mineral sector should go hand in hand with building local capacity and ensuring that our resources are a foundation for diversified economies—not just exports of raw materials,” said an economic adviser to one African government.

Context in Current Global Affairs

The US push for critical minerals from Africa unfolds against a backdrop of intensifying competition between major powers. The war in Ukraine has reshaped energy markets and global alliances; supply chain disruptions from the pandemic continue to reverberate; and the transition to green energy has accelerated demand for battery‑related minerals.

At the same time, China’s Belt and Road Initiative (BRI) has expanded its influence through infrastructure and trade networks, including in Africa. Beijing’s approach has delivered roads, railways, and industrial parks, but has also drawn scrutiny over debt sustainability and local ownership.

In response, the United States and like‑minded partners have launched alternative initiatives aimed at sustainable infrastructure financing. Notable among these is the US‑led Partnership for Global Infrastructure and Investment (PGII), which seeks to mobilise public and private capital for resilient, climate‑smart projects worldwide.

The focus on critical minerals adds another layer to this global contest for influence—a contest not fought with weapons, but with investment strategies, market access, and diplomatic engagement. For Africa, this competition presents both opportunity and urgency: nations with rich mineral endowments have the chance to negotiate terms that promote industrial growth and long‑term prosperity.

Potential Economic Impact

If successful, expanded critical mineral partnerships with the United States could spur significant economic activity across Africa. Investments in exploration, extraction, processing, and refining would create jobs and stimulate related sectors such as transportation, power, and manufacturing.

Experts also see potential for Africa to become a hub for value‑added industries rather than only a source of raw materials. With the right policy frameworks and infrastructure investments, countries could process minerals domestically, capturing more of the economic value before export.

However, to realise this potential, African governments will need to strengthen regulatory environments, improve governance standards, and ensure transparent revenue management. These reforms, while challenging, are essential to attract long‑term, responsible investment that benefits local populations.

Looking Ahead

As Washington deepens its engagement on critical minerals, Africa finds itself at a crossroads of global economic transformation. The choices made by governments and private sector actors in the coming years will shape not only the continent’s role in global supply chains, but also the economic prospects of millions of Africans.

In a world where competition for strategic resources is intensifying, Africa’s mineral wealth has never been more important. What matters now is how that wealth is harnessed—for inclusive growth, sustainable development, and partnerships that respect both national interests and global responsibilities.